Solar Loans, Subsidies & EMI Plans: Financing Made Easy

Installation of solar systems on either home rooftops or C&I (Commercial and Industrial) requires a lot of capital. And there are many banks and financing companies that offer financing options at a lower interest rate.

Each option can be beneficial for different types of installation, depending on the type of feasibility the customer is looking for. Broad options like homeowners and businesses can choose bank/DFI loans, PSU financing, NBFC loans, or PPAs/RESCOs.

In 2025, the market is actively opting for alternative options rather than paying for it at once, and NBFCs and similar platforms have seen scaling up for quick loan disbursals. This has given users a better choice and options than what was available a few years ago.

Benefits For Home And Commercial Solar Installations

For house rooftop solar installations, loans and subsidies reduce a lot of the struggle. So it is easier for people to own their system and enjoy cost-cutting. Below are some of the advantages listed for opting for financing options in case of house solar rooftops:

1. Lower Monthly Electricity Bills

Homeowners get to save from day one, once financing for their rooftop solar systems. In many cases, it was observed that the EMI payments were either equal to or lower than the amount of power saved. This makes the investment financially neutral or even profitable.

2. Increased Property Value

Houses with solar panel installations are often perceived as premium properties in urban and suburban regions. A financing option will increase the demand price for the buyers, without even having to make the full payment for the setup.

3. Access to Subsidies Without Large Upfront Capital

Financing often opens doors for house owners to claim MNRE’s residential rooftop subsidy and state incentives, without heavy collateral. This makes the solar panel installation process seamless and affordable for middle-class families.

With cost-cutting being the major advantage for house owners, businessmen, and industrialists can get long-term loans, which are suitable for large rooftops. Below are some of the advantages of financing options for commercial setups.

1. Operational Cost Reduction

Businesses can reduce a big chunk of their monthly expenses by setting up solar panels themselves. With financing options, the monthly deposit/payments are often less as compared to monthly electricity bills that were previously paid. Additionally, savings on energy costs directly elevate profit margins over time.

2. Preserves Working Capital

Rather than spending a large sum on installation directly, financing allows businesses to distribute the cost over years. This way, the amount can be invested in other operational needs like expansion, inventory, or marketing.

3. Tax and Depreciation Benefits

Financing for commercial solar setups under a loan or lease model allows them to opt for accelerated depreciation benefits, which significantly reduce their taxable income over the entire life of the asset. This boosts the ROI and reduces the overall tax liabilities simultaneously.

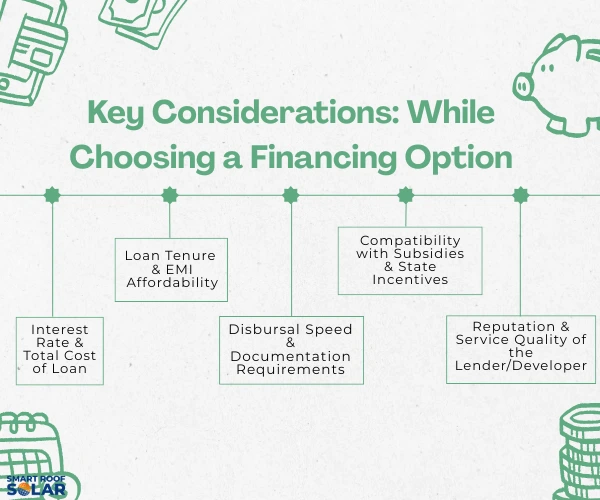

Key Considerations: While Choosing a Financing Option

Different types of financial options can be advantageous to different people, based on the type of requirement and liability they are looking for. Some of the key considerations are listed below, which may help users who want to opt for financing and will help filter out their needs.

1. Interest Rate & Total Cost of Loan

Factors like processing fee, GST on charges, documentation costs, and any penalties should be considered, along with the interest rate. Even a 0.5% difference in rates can make a huge debt over a loan’s lifetime.

Make sure to confirm if the lender adjusts the principal amount before or after subsidy deduction. This may affect the EMI payments from the beginning.

2. Loan Tenure & EMI Affordability

Longer loan tenure increases the repayment over the months and reduces the EMI. This is helpful for housing societies, managing multiple expenses, or businesses with seasonal cash flow.

But in total, the longer tenure also means paying more in interest, so make sure to understand the financials to bridge the gap between monthly affordability and overall cost.

3. Disbursal Speed & Documentation Requirements

If the solar project needs quick installation, choose an option that releases loans quickly. NBFCs and fintech platforms often take a few days with minimal paperwork, while PSUs may take weeks.

Make sure to check the document list to shorten the process. Some options may ask for extensive property and income proofs, while others need basic KYC and some utility bills.

4. Compatibility with Subsidies & State Incentives

Not all financing companies handle MNRE or state subsidies in the same way. Some help in factoring it, which further reduces the principle before EMI calculation

While others may need you to claim it separately and then ask for the final principal amount. Clarify these things and coordinate with the agencies so that you are free of paperwork and any hassle later.

5. Reputation & Service Quality of the Lender/Developer

A low interest rate is of no use if there are any hidden clauses or poor services. For PPA or RESCO models, ensure their market reputation in maintenance, billing transparency, and that they follow their buyout clauses.

Read reviews about after-sales support, EMI management, and hidden policies, which may come up at a later time, affecting the loan repayment amount.

Popular Financing Options

1. SIDBI (Small Industries Development Bank of India)

- SIDBI has been a popular choice for MSMEs that want to choose solar as a renewable alternative.

- Offers like special green credit lines and SIDBI GIFT schemes provide concessional interest rates and interest subventions.

- This loan can cover up to 80-90% of the project cost, with repayment terms according to MSME cash flows.

2. PSU Financing (REC, PFC, and State-run Banks)

- Public Sector Undertakings (PSUs) like Rural Electrification Corporation (REC) and Power Finance Corporation (PFC), along with state banks, provide large-scale financing at comparatively lower interest rates.

- This option is ideal for big rooftop or ground-mounted projects like factories, malls, and institutional campuses.

- They offer longer repayment periods, going up to 15 years, making it attractive for larger projects. But the processing time is longer and the documentation is stricter.

3. PPA / RESCO Model

- In a Power Purchase Agreement (PPA) or Renewable Energy Service Company (RESCO) model, the customer pays nothing up front.

- Rather, a solar developer installs and owns the system and sells the generated electricity at a fixed per-unit rate.

- Usually, the rates are 20-40% lower than the grid tariff, and are perfect for people who don’t want to take a loan or invest capital.

- Many PPAs have buyout options after a period of time, allowing ownership later.

4. NBFC & Fintech Lenders

- Non-Banking Financial Companies (NBFCs) and fintechs offer quick loan approvals and flexible EMI plans that save on electricity bills.

- Many also provide pre-approved loan amounts for previous customers or partners within 48 hours.

- The interest rate is comparatively higher, which is often balanced by speed, flexibility, and low documentation burden.

Conclusion

Financing options for solar setups have grown massively in 2025, from SIDVI and PSUs to NBFCs and PPA models. Choose the option that matches your requirement and budget for savings.

For reference, you can talk to us at Smart Roof Solar, and we’ll help you choose the right finance path. With smart financing, solar can become a fast and reliable way for cost-cutting. Connect with us and install solar panels at reasonable rates and right financing option.

FAQs

Q1. Can I combine a subsidy and a bank loan?

Ans: Yes, many banks and lenders accept MNRE or state subsidy as part of the loan appraisal, but confirm with the lender first.

Q2. Do NBFC loans cost more than PSU loans?

Ans: Often, NBFCs are faster but slightly costlier. PSUs/DFIs usually offer lower rates with longer processing times.

Q3. What is PPA: Is ownership possible later?

Ans: Some PPAs include buyout clauses allowing the consumer to purchase the system after a period. Make sure to check the contract details.

Q4. Are there special loans for MSMEs?

Ans: Yes, SIDBI and some NBFCs have MSME-tailored green loan products with interest subventions and flexible tenors.

Q5. How quickly can loans be sanctioned?

Ans: NBFC/fintech loans can be released in days to weeks, depending on the type of lender. PSU/DFI loans may take longer, but can offer better rates and higher limits.

Suggested Articles

Haryana’s GEOA 2025: A Boost for Captive Solar Plants and Wind Energy Developers

Haryana’s GEOA 2025 paves the way for growth in captive solar and wind energy projects with investor-friendly reforms.

China’s Solar Industry Poised for Continued Growth in 2023 and Beyond

China’s solar industry is set for continued growth in 2023 and beyond, driving global renewable energy expansion and technological advancements.

Blame it on Sun! Average Solar PLFs not satisfactory

Poor performance of solar projects has become a cause…

6 Innovative Applications of Solar Energy

Innovations and discoveries are constantly occurring in the field of solar energy. The pioneers in this field are constantly seeking more and more affordable ways to meet the demands of an eco-friendly future.

The Rise of Clean Energy: Solar Energy Trends in 2023

The solar energy industry is on the rise, as the demand for clean and renewable energy sources continues to increase. 2023 is shaping up to be a big year for the solar energy sector, as new technologies and innovations are expected to drive growth and expand the reach of solar energy.

Can Industries run Rooftop Solar Plant with Diesel Generators (DG) also?

Many industries in Delhi/NCR (Kundali, Sonipat, Faridabad,…

Researchers Develop Technique to Improve Durability of Perovskite Solar Cells

Researchers have introduced a new technique to enhance the durability of perovskite solar cells, paving the way for more reliable and long-lasting renewable energy solutions.

Latest MNRE List: Approved Solar Module Manufacturers

Check the latest MNRE-approved list of solar module manufacturers to ensure quality and compliance for your solar projects in India.

Solar panel selection demystified

With rapid growth in solar PV sector in India, market is…

Petrol Pumps: Need to take a step towards Solar

Over 50,000 Petrol Pump stations in the country…