UP Discoms Propose 9.21% Electricity Tariff Hike for 2015-16

UP Discoms Propose 9.21% Electricity Tariff Hike for 2015-16

Uttar Pradesh Discoms have filed the petition on 2nd February 2015 for the tariff increase for the year 2015-16 which is now being heard by UPERC. The Discoms have proposed a hike in the UP electricity tariff by 9.21% though the tariff required to meet the full revenue gap is 19.59%. The biggest percentage increase inUP electricity tariff has been proposed for the domestic consumers which can go up to 19% for the consumers in the lowest consumption slab.

The variable tariff in Uttar Pradesh consists of energy charges, regulatory surcharge and taxes as shown below. The regulatory surcharge and tax are together calculated as 10.22% of energy charges and demand charges. As such any increase in energy and demand charges will lead to increase in these charges also.

Domestic Consumers:

The variable charges to be paid by a domestic urban consumer are as follows –

| Units consumed (Units or kWh) | Energy Charges (Rs per kWh) | Tax (5%) | Regulatory Surcharge (5.22%) | Variable Charges (Rs per kWh) | |

| Metered Domestic Consumer | 600 | 5.63 | 0.28 | 0.29 | 6.20 |

The benefit of telescopic UP electricity tariff i.e. the lower tariff for lower consumption slab is available to all the consumers in the state unlike in neighboring Haryana state.

Commercial Loads:

The small commercial consumers have a telescopic UP electricity tariff with any units consumed over 1000 kWh attracting the Energy charges of Rs 7.1 per kWh. The variable tariffs for these consumers having a consumption of 1000 units and 1500 units per Month are as below.

| Units consumed (Units or kWh) | Energy Charges (Rs per kWh) | Tax (5%) | Regulatory Surcharge (5.22%) | Variable Charges (Rs per kWh) | |

| NON DOMESTIC LIGHT, FAN AND POWER | 1000 | 6.64 | 0.33 | 0.35 | 7.31 |

| 1500 | 6.79 | 0.34 | 0.35 | 7.48 | |

| Private Advertising / Sign Posts / Sign Boards / Glow Signs / Flex | 14.00 | 0.70 | 0.73 | 15.43 |

As shown above, the variable tariff for the advertising sign boards is the highest in the state.

However, for the commercial loads over and 75 KW, the charges are significantly higher as shown below. These consumers are charged per kVAh energy tariff. In the table below, the energy charges are converted to per kWh using a power factor of 0.9.

| Commercial Loads / Private Institutions / Non domestic bulk power consumer with contracted load 75 kW & above | Energy Charges (Rs per kWh) | Tax (5%) | Regulatory Surcharge (5.22%) | Variable Charges (Rs per kWh) |

| Commercial Loads / Private Institutions / Non domestic bulk power consumer with contracted load 75 kW & above | Energy Charges (Rs per kWh) | Tax (5%) | Regulatory Surcharge (5.22%) | Variable Charges (Rs per kWh) |

| At 11 kV | 7.56 | 0.38 | 0.39 | 8.33 |

| At 33 kV & above | 7.33 | 0.37 | 0.38 | 8.08 |

| Public Institutions, Registered Societies, Residential Colonies / Townships, Residential Multi-Storied Buildings including Residential Multi-Storied Buildings with contracted load 75 kW & above | ||||

| At 11 kV | 7.33 | 0.37 | 0.38 | 8.08 |

| At 33 kV & above | 7.11 | 0.36 | 0.37 | 7.84 |

Industries:

For the small and medium size industries, the variable charges vary from Rs 6.83 to Rs 7.49 per kWh as shown in the table below.

| SMALL AND MEDIUM POWER (<75 KW) | Energy Charges (Rs per kWh) | Tax (5%) | Regulatory Surcharge (5.22%) | Variable Charges (Rs per kWh) |

| 0 – 1000 kWh / month | 6.20 | 0.31 | 0.32 | 6.83 |

| Above 1000 kWh / month | 6.80 | 0.34 | 0.35 | 7.49 |

For large and heavy industries, the variable charges are again specific in per kVAh terms which are converted in the table below using a PF of 0.9. The UP electricity tariffs are the highest for the industries connected at 11 KV voltages as shown below.

| LARGE AND HEAVY POWER | Energy Charges (Rs per kWh) | Tax (5%) | Regulatory Surcharge (5.22%) | Variable Charges (Rs per kWh) |

| For supply at 11 kV | 7.00 | 0.35 | 0.37 | 7.72 |

| For supply above 11 kV and up to & including 66 kV | 6.67 | 0.33 | 0.35 | 7.35 |

| For supply above 66 kV and up to & including 132 kV | 6.44 | 0.32 | 0.34 | 7.10 |

| For supply above 132 kV | 6.22 | 0.31 | 0.32 | 6.86 |

In fact the Discom tariffs in Uttar Pradesh are on the lower side vis-à-vis that in the other neighbouring states. However due to the year round power cuts, the consumers end up paying much more as they have to constantly invest in the Investors and the Diesel Generator sets.

Suggested Articles

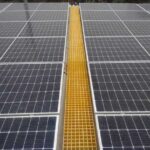

Solar Panel Installation on Tiled Roofs: Complete Homeowner Guide

When you’re ready to install solar panels on your home, there are many factors that will determine the unique design and cost of your solar system. Various roof types require different processes for installation. For example, lightweight tile roofs can present unique challenges and considerations for a solar installer. Here are a few things you need to know before adding solar energy to your tile roof.

Complete Guide To 100 kW Solar Setup Cost And Benefits In Uttar Pradesh

Planning to install a 100 kW solar power plant in Uttar Pradesh? This guide covers everything — from installation costs and available subsidies to long-term savings and payback time. Learn how investing in solar can reduce your electricity expenses and support a sustainable energy future for your business.

How to Calculate Savings from Rooftop Solar Solutions: A Complete Guide

Calculating savings from rooftop solar solutions is essential for planning your investment. This guide explains how to estimate cost reduction, return on investment, and long-term financial benefits for residential, commercial, and industrial solar projects.

Law Change Makes It Hard to Receive Compensation for Solar Developers

A recent law change creates hurdles for solar developers seeking compensation, impacting project viability.

How a String Monitoring Box Works in Residential Solar Systems

Understand how a string monitoring box helps track and protect your home solar panels for maximum efficiency and safety

How to Improve Energy Efficiency and Save Electricity Costs

Learn how energy conservation and efficiency can help you save electricity, cut costs, and make your home or business more sustainable

Top 10 Sustainable Building Practices to Consider for Your Construction Business

The construction industry is embracing sustainability like never before. From smart design to renewable energy use, these top 10 practices ensure businesses stay competitive, compliant, and environmentally responsible.

Solar Rooftop: अपने घर को बनाओ खुद का पावर हाउस | Complete Guide

सौर रूफटॉप सिस्टम आपके घर को पावर हाउस बना सकता है। यह न केवल बिजली के बिलों में बचत करता है, बल्कि साफ और नवीकरणीय ऊर्जा भी प्रदान करता है। जानें सौर पैनल की इंस्टालेशन प्रक्रिया, लागत, लाभ और कैसे यह आपके घर को आत्मनिर्भर ऊर्जा का स्रोत बना सकता है।

Solar Cell Technology: Monocrystalline vs Polycrystalline vs Thin-Film

Explore the different types of solar cells, including monocrystalline, polycrystalline, and thin-film, and learn their efficiency, applications, and benefits for solar energy systems.

Renewable Energy Hits New Heights: 440 GW Capacity in 2023

Learn how global renewable energy capacity is set to surpass 440 GW in 2023, marking record growth and a major shift toward clean, sustainable power.